Effective PrimeXBT Crypto Trading Strategies for Success

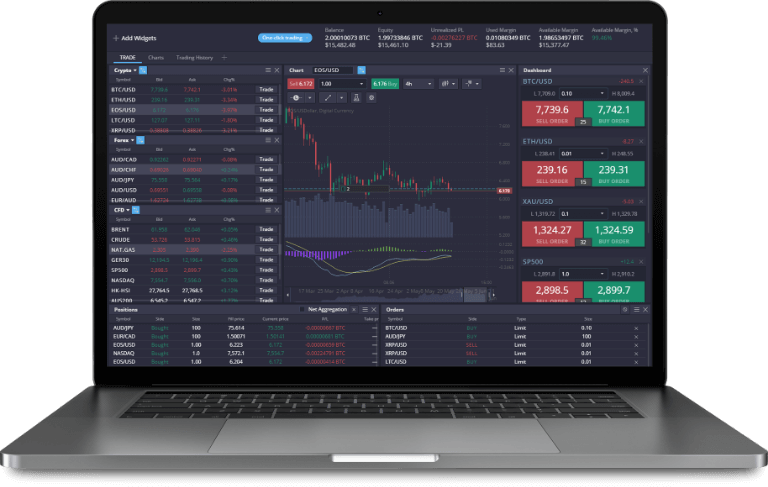

The world of cryptocurrency trading can often seem daunting, especially for newcomers. However, understanding and implementing effective trading strategies can significantly enhance your chances of success. One platform that has gained significant traction among traders is PrimeXBT, known for its robust trading environment and advanced features. In this article, we will explore several PrimeXBT Crypto Trading Strategies PrimeXBT trading strategies that can help you navigate the complexities of crypto trading with confidence.

Understanding the Basics of Crypto Trading

Before diving into specific strategies, it is crucial to grasp the fundamental concepts of cryptocurrency trading. Unlike traditional stock markets, the crypto market operates 24/7, providing endless opportunities for traders. The volatility associated with cryptocurrencies presents both risks and rewards. Successful trading requires a solid understanding of market trends, price action, and emotional discipline.

1. Trend Following Strategy

One of the most popular strategies among traders is the trend-following strategy. This approach is based on the idea that once a trend is established, it is likely to continue in that direction. Traders utilizing this strategy will analyze market charts and indicators to identify upward (bullish) or downward (bearish) trends. For example, moving averages can serve as a reliable indicator to help traders determine the trend direction. When the price is above the moving average, it is typically considered bullish, while being below may indicate bearish conditions.

2. Range Trading Strategy

The range trading strategy is an effective approach when the market lacks clear trends. This strategy involves identifying support and resistance levels, where prices tend to bounce between a defined range. Once these levels are established, traders can place buy orders near support levels and sell orders near resistance levels. This strategy is often employed in conjunction with various technical indicators to confirm entry and exit points.

3. Breakout Strategy

Breakout trading is a strategy that focuses on entering the market when the price breaks through established support or resistance levels. This can indicate that a significant price movement is likely on the horizon. Traders often utilize volume and volatility indicators to confirm breakouts. It is essential to set stop-loss orders to manage risks effectively, as false breakouts can occur frequently in volatile markets.

4. Scalping Strategy

Scalping is a short-term trading strategy aimed at capitalizing on small price movements within the market. Traders who employ this strategy often make multiple trades throughout the day, holding positions for just a few minutes or seconds. This requires a high degree of focus, quick decision-making skills, and a reliable trading setup. Scalpers benefit from PrimeXBT’s low latency trading environment, which allows them to execute trades rapidly and efficiently.

5. Position Trading Strategy

For traders who prefer a longer-term approach, position trading may be the ideal strategy. This involves holding positions for an extended period, often weeks or months, and focusing on the long-term trends within the market. Position traders typically rely on fundamental analysis, news events, and macroeconomic factors to inform their trading decisions. This approach requires patience and a solid understanding of market dynamics.

6. Risk Management Strategies

Regardless of the trading strategy employed, effective risk management is paramount to success in cryptocurrency trading. Establishing clear risk parameters can help protect your capital from significant losses. Here are a few essential risk management strategies:

- Set Stop-Loss Orders: Always set stop-loss orders to limit your potential losses on each trade.

- Diversify Your Portfolio: Avoid putting all your capital into a single asset. Diversifying can help spread risk across different cryptocurrencies.

- Use Position Sizing: Determine the percentage of your capital you are willing to risk on each trade based on your overall strategy.

- Avoid Over-Leveraging: While leveraging can amplify gains, it also significantly increases risk. Use leverage wisely and understand the implications thoroughly.

The Importance of Continuous Learning

The cryptocurrency market is dynamic, with trends and technology changing rapidly. As a trader, it is essential to commit to continuous learning and adaptation. Stay updated with news, trends, and changes in regulations that may impact the market. Engage with online communities, read educational articles, and participate in webinars to improve your skills. The more knowledge you acquire, the better equipped you’ll be to make informed trading decisions.

Conclusion

In conclusion, the key to successful cryptocurrency trading on platforms like PrimeXBT lies in implementing effective trading strategies, managing your risks wisely, and committing to ongoing education. Whether you prefer short-term strategies like scalping or long-term approaches like position trading, understanding your own risk tolerance and trading style is crucial. Always remember that there is no one-size-fits-all solution; flexibility and adaptability are vital in the ever-evolving cryptocurrency landscape.